Up to now, the 2024 election has offered the suspense and drama we’ve got come to count on in presidential election years. For traders, the identical questions proceed to plague us as we await the winner in November.

Are there indicators within the motion of markets that we, as traders, must be profiting from?

Who is best for markets? Republicans or Democrats?

Will the market collapse if one candidate is elected?

Are there particular market segments or industries we must always give attention to/transfer away from relying on the election consequence?

Is that this the identical dialog we’ve got each 4 years, or is that this time totally different?

The political warmth and variations of opinion have been extraordinary this 2024 election season. It’s no marvel many are feeling nervousness about how the result might have an effect on their monetary well being.

Reflections on Democracy and Capitalism

Whereas democracy and capitalism don’t require one another, they do go collectively like peanut butter and jelly. Whereas they’re complementary, there’s something psychologically difficult about each. On some stage, they’re each messy processes. Capital markets can really feel chaotic. Nobody particular person oversees the place the inventory or bond market must be. Nobody absolutely controls the continued public sale of each share of each firm that’s on the market all over the world. Nobody congress, president, central financial institution, or different physique controls the inventory market. This lack of central management can result in stress and nervousness. The identical will be stated for democracy.

Picture supply: https://www.dimensional.com/

The identical is usually stated of capitalism. Whereas capitalism is messy and typically disappoints us, it appears to be the easiest way to allocate assets in a profitable manner. A optimistic manner to consider that is that each democracy and capitalism are dynamic, reply to stress and forces in society, and profit us as residents and traders.

Who Is Higher for Markets? Republicans or Democrats?

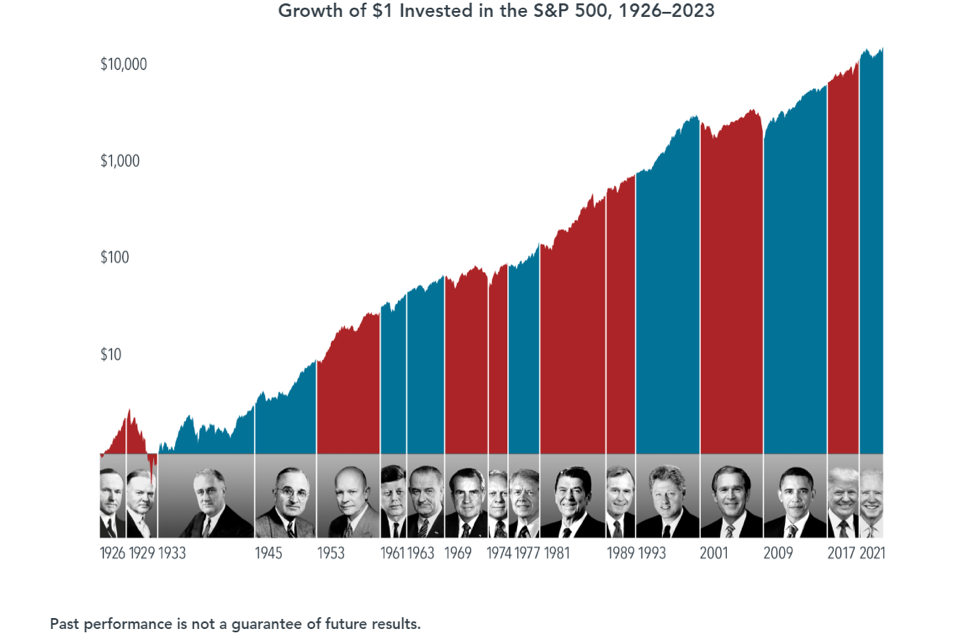

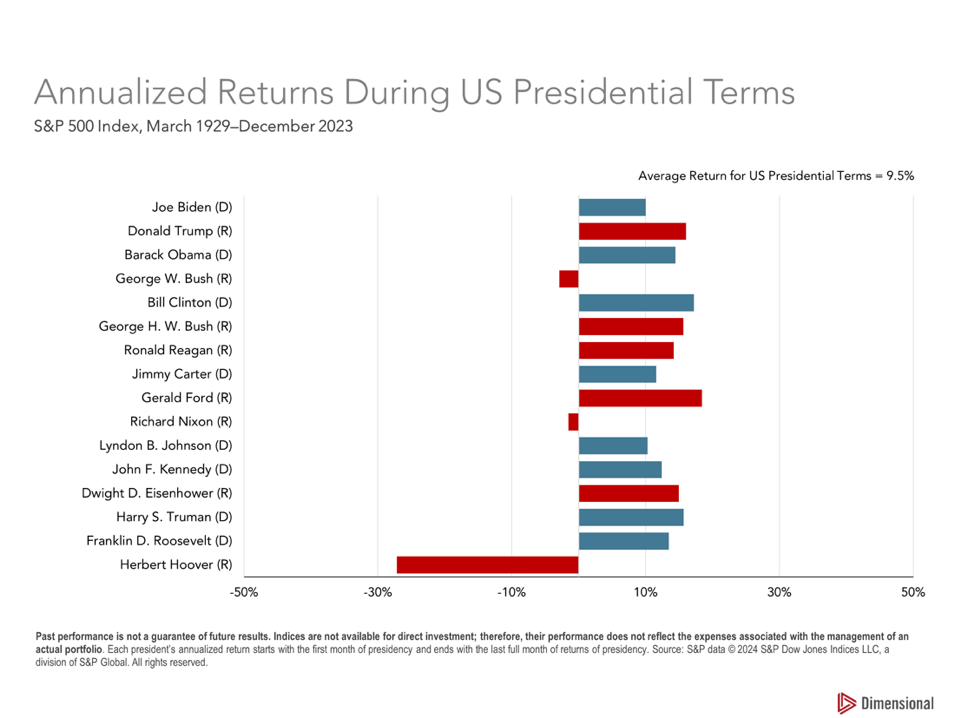

Whereas there are numerous theories about whether or not Republican or Democratic insurance policies are higher for the inventory market, what we see within the information is that over the long run, the inventory market has rewarded traders no matter who’s in workplace. There’s not a dramatic distinction. If we actually need to select a political social gathering with higher inventory market outcomes, we see that till the top of 2019, Democratic administrations have had a slight edge. Why is that? That is largely a results of Republican presidents governing by way of sturdy adverse occasions such because the Nice Despair, 9/11, and the Nice Monetary Disaster:

Whereas political exercise influences progress, the sum of the economic system, GDP, and capital markets are bigger than what any president, congress, or political social gathering can management. Most presidents preside over sturdy market returns. For these causes, we see no clear proof round which to construct a strategic funding thesis based mostly on who will win the election.

Why Doesn’t the Market Have a Desire?

The day by day public sale within the markets displays all future opinions-both knowledgeable and uninformed within the type of a worth for all positions going ahead. The web result’s that the aggressive market is so good at pricing belongings that it’s the finest repository of what’s going to occur going ahead. These costs will be harnessed to offer us a way of what is going to occur going ahead. This offers us the selection as traders of how we reply to the 24-hour information cycle. You’ll be able to permit the market to cost in all that uncertainty and preserve your funding plan regardless of it. That could be a highly effective alternative.

How Do Our Political Opinions Coloration Our Views on the Financial system and Investing?

Lots of our sturdy opinions are strengthened by the media and information sources we select to devour. We have a tendency to pick media sources that assist the biases we already maintain. Watching the information, as they are saying, will be costly. It’s essential to do not forget that the objective of most media retailers shouldn’t be so that you can be a profitable long-term investor; it’s to maintain you engaged and enhance the chances you purchase services and products from their advertisers and/or donate to their chosen causes. The previous adage, “If it bleeds, it leads,” reminds us that tales that breed worry, anger, and uncertainty are prone to obtain essentially the most airtime and maintain viewers in a susceptible state.

Is There Any Overlap Between Politics and Investing?

Whereas diversified traders usually don’t want to fret about political change influencing their long-term anticipated return, some enterprise homeowners and extremely compensated staff might have a a lot increased publicity to this threat. You probably have that type of human capital threat, there could also be selections that you need to make. There may be new tax methods to judge and different issues to your total wealth. Nonetheless, there’s a large alternative price to creating important adjustments inside your funding plan. Whereas it might really feel good to sit down out of the market whereas your group shouldn’t be within the workplace, if, on the finish of that interval, the market has not suffered, you’ve gotten misplaced cash on that commerce. Emotionally you’ll have felt higher, however you paid the value within the type of decrease lifetime wealth.

Is This the Identical Dialog We Have Each 4 Years? Or Is the 2024 Election Completely different?

Once we are within the fever of an election, it’s straightforward to view right this moment as essentially the most intense interval ever. Whereas political views are extraordinarily far aside proper now, this isn’t the primary time this has occurred in our historical past. Capitalism has all the time stored going. There aren’t any indicators to consider the nation is on the verge of one thing dramatically problematic. Capitalism encourages individuals to make cautious, secure choices that profit themselves, and good issues are likely to occur even with volatility. Nothing in right this moment’s political noise would counsel Warren Buffett’s sentiment that the US is a good place to speculate is improper or negate the immense progress that has continued by way of election cycles, recessions, and bear markets.

What Ought to We Do Subsequent?

Whereas we’ve got made the case that the present state of affairs doesn’t warrant important funding adjustments, typically in durations of tumult and volatility, it’s useful to focus our consideration on areas the place we will have essentially the most optimistic impression:

We might be right here patiently awaiting the 2024 election outcomes and perceive that you’ll have issues concerning the present surroundings. Please contact us if you want to debate how these occasions impression your private monetary state of affairs.

Allison Berger

As an skilled Monetary Advisor and companion, Allison builds customized monetary options to reinforce right this moment and enrich tomorrow for our Wealth Administration shoppers. Allison has a selected curiosity in working with shoppers in or on the cusp of retirement who need to delegate their portfolio administration to allow them to get pleasure from life.