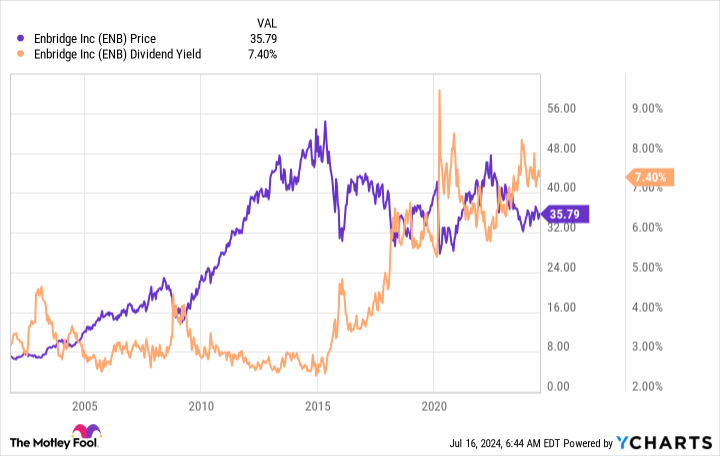

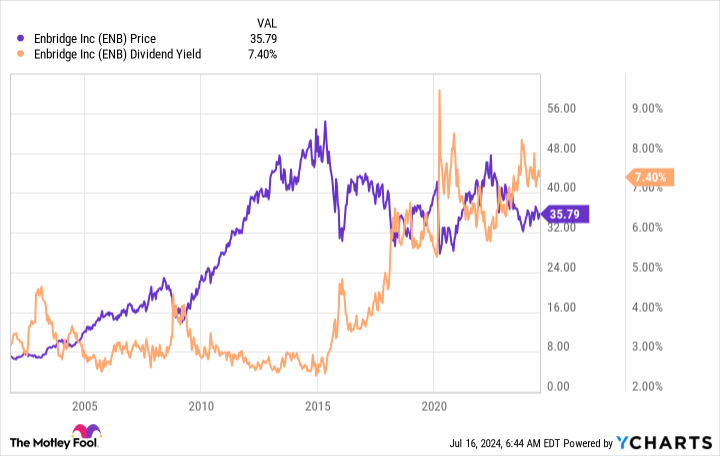

Enbridge (NYSE: ENB) is just not an thrilling firm, however that is truly one of many greatest points of interest right here. That and an ultra-high dividend yield of round 7.4%. However to actually admire why you may be glad you purchased this inventory in a number of years, you could take a deeper dive into its enterprise and the way it returns worth to buyers over time.

Enbridge is greater than a midstream big

The power sector is understood for being risky, however not each firm within the business deserves that label. Upstream (drilling) and downstream (refining and chemical substances) companies are sometimes fairly risky, however midstream companies like Enbridge often aren’t. That is as a result of midstream corporations personal the power infrastructure (like pipelines) that connects the upstream to the downstream, and the remainder of the world, and so they largely cost charges for the usage of their property.

Enbridge is, principally, a toll taker. And since oil and pure fuel are important to the world functioning easily, demand tends to stay sturdy even when power costs are weak. Oil pipelines account for round 50% of earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) whereas pure fuel pipelines make up roughly 25%. Which is the place the subsequent attention-grabbing reality about Enbridge arises.

The remainder of the power big’s enterprise comes from regulated pure fuel utilities (22% of EBITDA) and renewable energy investments (3%). Pure fuel is cleaner-burning than coal or oil and is seen as a transition gas. Enbridge lately agreed to purchase three pure fuel utilities from Dominion Power, which elevated its publicity to this power area of interest from 12% as much as above 22%. Regulated utility property are given a monopoly within the areas they serve in change for being required to get charges and funding plans accepted by the federal government. That tends to result in gradual and regular progress over time. In brief, Enbridge’s enterprise is much more dependable because of this funding.

Then there’s the renewable energy enterprise, which is pretty small relative to the remainder of the corporate. However then clear power continues to be a comparatively small piece of the worldwide power pie, too. The truth that Enbridge is increasing into the house is principally an try to make use of its carbon gas earnings to vary together with the world as clear power turns into extra vital over time. It represents a hedge, of kinds, for buyers who aren’t prepared to leap into renewable energy however acknowledge its rising function on the earth.

What can buyers anticipate from Enbridge?

So Enbridge is a boring midstream firm that is slowly altering its enterprise in a cleaner route. That is not precisely an thrilling story till you consider the massive 7.4% dividend yield. Most buyers anticipate the inventory market as an entire to offer returns of roughly 10% a yr, so Enbridge’s dividend alone will get you roughly three-quarters of the best way there.

Story continues

That dividend, in the meantime, is backed by an investment-grade-rated steadiness sheet. And the distributable-cash-flow payout ratio is correct in the course of administration’s 60%-to-70% goal vary. The dividend has additionally been elevated yearly for 29 consecutive years. This can be a dependable dividend inventory and there isn’t any purpose to consider that the dividend is in danger. In truth, it appears extremely probably that gradual and regular dividend progress within the low single digits is an inexpensive expectation.

So, if the dividend grows roughly according to inflation, at about 3%, the entire return buyers can anticipate might be about 10%, including the present 7%-plus yield to the dividend enhance of round 3%. Usually, shares rise together with their dividends over time to maintain the yield fixed, so market-like returns from this high-yield inventory is not an unrealistic expectation. That is arduous to complain about, significantly should you reinvest your dividends, which permits them to compound over time.

The bottom case for Enbridge is nice

It appears probably that Enbridge can handle to simply plod alongside doing what it’s doing. That might be sufficient to offer stable returns to buyers, as famous above. However what’s attention-grabbing right here is that Enbridge’s dividend yield is traditionally excessive in the present day. So it truly seems like it could be buying and selling at a depressed worth.

It’s totally doable that this example does not change and the yield has merely risen into a brand new vary to mirror Enbridge’s enterprise because it stands in the present day. Nonetheless, if Wall Road abruptly turns into extra within the firm, buyers who purchase in the present day will get a lift from elevated demand for the shares. The bottom case is for Enbridge’s boring enterprise to supply roughly market-like returns whereas the upside could possibly be a lot larger. That looks like a lovely danger/reward steadiness that you’re going to be sorry you missed out on should you do not soar aboard quickly.

Do you have to make investments $1,000 in Enbridge proper now?

Before you purchase inventory in Enbridge, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Enbridge wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $722,626!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 15, 2024

Reuben Gregg Brewer has positions in Dominion Power and Enbridge. The Motley Idiot has positions in and recommends Enbridge. The Motley Idiot recommends Dominion Power. The Motley Idiot has a disclosure coverage.

A Few Years From Now, You may Want You’d Purchased This Undervalued Excessive-Yield Inventory was initially revealed by The Motley Idiot