A concentrated rally raises questions—are there nonetheless undervalued gems out there?

Utilizing a confirmed inventory screening technique, we have pinpointed three undervalued shares with 30%+ upside.

Kick off the brand new yr with a portfolio constructed for volatility and undervalued gems – subscribe now throughout our New Yr’s Sale and stand up to 50% off on InvestingPro!

Volatility may make a comeback in 2025, with forecasts predicting a shift in market dynamics after two years of practically uninterrupted positive factors.

Many monetary consultants are anticipating a correction, and whereas that may sound unsettling, extra volatility usually interprets into contemporary alternatives—particularly in immediately’s hyper-concentrated market.

A Rally Pushed by Only a Few Shares

The surge within the since October 2022 has been exceptional, climbing practically 70%. Nonetheless, this rally has been largely fueled by a handful of powerhouse shares—notably these tied to the AI increase.

As Duncan Lamont, CFA, Head of Strategic Analysis at Schroders, identified, the six largest U.S. corporations now maintain a mixed market share larger than the following six largest nations—Japan, the UK, Canada, France, China, and Switzerland—mixed. The load of those six shares is the same as that of two,000 of the smallest world corporations.

One standout is Nvidia (NASDAQ:), whose market capitalization has soared by over $2 trillion this yr alone, a determine greater than double the entire worth of Italy’s inventory market.

Are There Nonetheless Undervalued Gems within the Market?

With a couple of shares driving the market’s momentum, many surprise if there are different high-quality, undervalued corporations nonetheless ripe for progress. The reply is sure—although discovering them is not any easy activity. Screening for these alternatives takes time, and as seasoned buyers know, time is cash.

That’s the place inventory screeners come in useful. With instruments like InvestingPro’s inventory screener, you’ll be able to shortly sift via potential candidates, making use of filters primarily based on key monetary metrics. This lets you give attention to shares which have sturdy fundamentals and important upside potential—with out getting misplaced within the noise.

Here is How I Discovered 3 Excessive-High quality Undervalued Shares With 30%+ Upside Potential

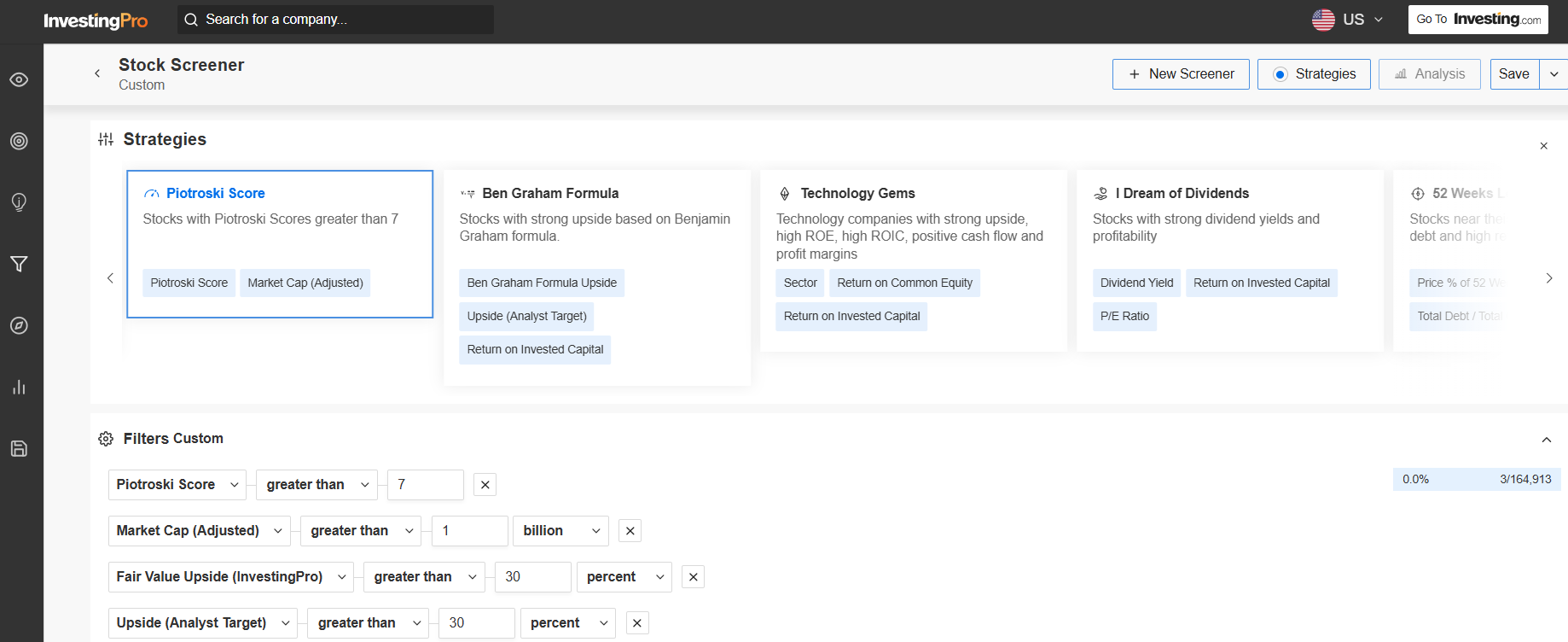

One highly effective methodology for figuring out high-quality shares is utilizing the Piotroski F-Rating, a system developed by Stanford professor Joseph Piotroski. This strategy evaluates corporations on 9 key metrics, together with profitability, liquidity, and working effectivity. Traditionally, this filter has delivered spectacular outcomes, with a median annualized return of 23% over twenty years.

Utilizing the Piotroski filter, you’ll be able to slim down your listing to corporations with excessive scores and strong fundamentals. Search for corporations that meet no less than eight of the 9 standards, specializing in these with optimistic returns, sturdy money movement, low debt, and increasing margins.

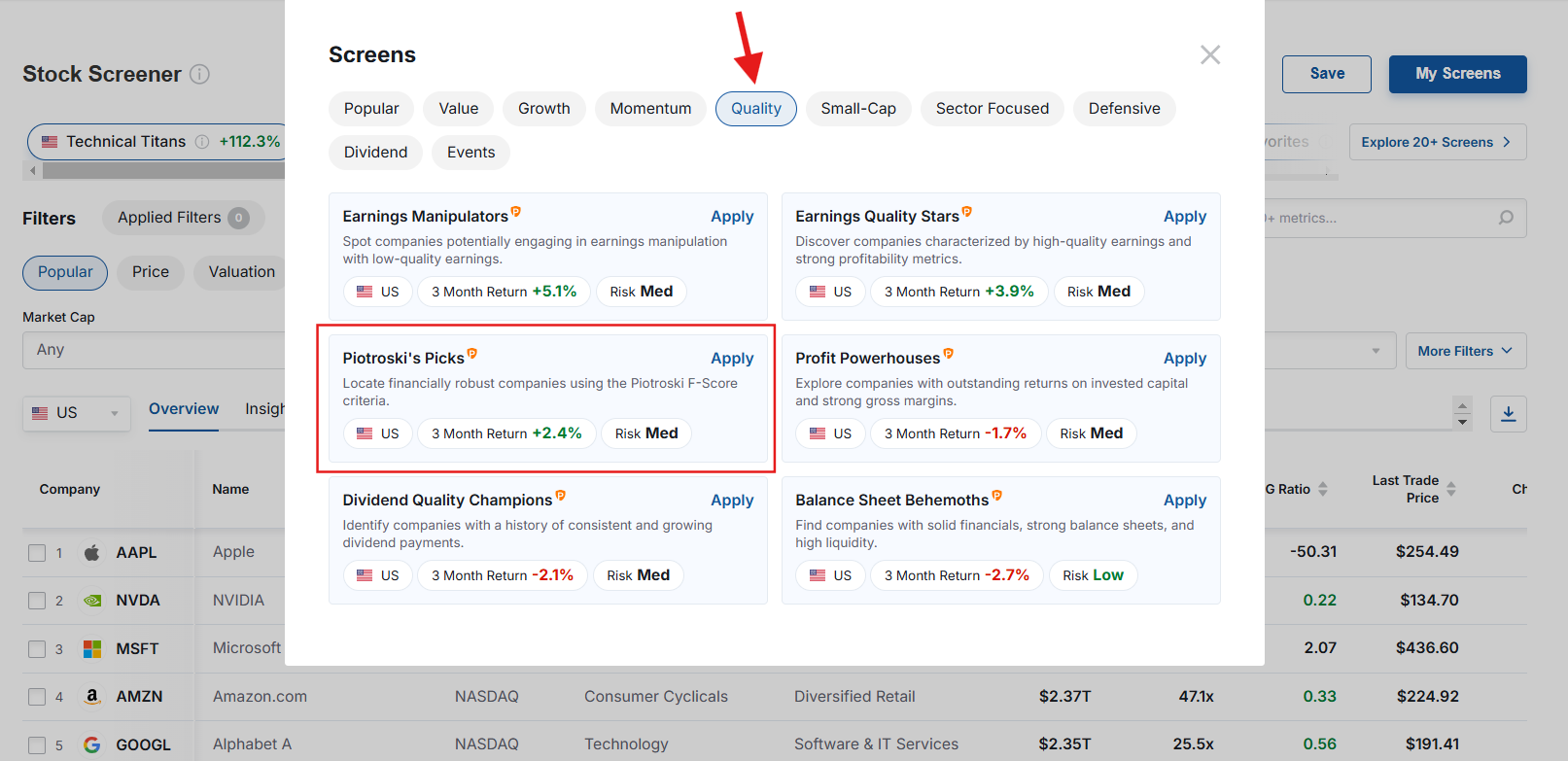

Supply: InvestingPro

After filtering for high quality, the following step is figuring out shares that additionally supply important upside potential. Utilizing predefined parameters—such at the least market cap of $1 billion and analysts’ goal costs—you’ll be able to additional refine your search to focus on solely shares with no less than 30% upside potential.

Supply: InvestingPro

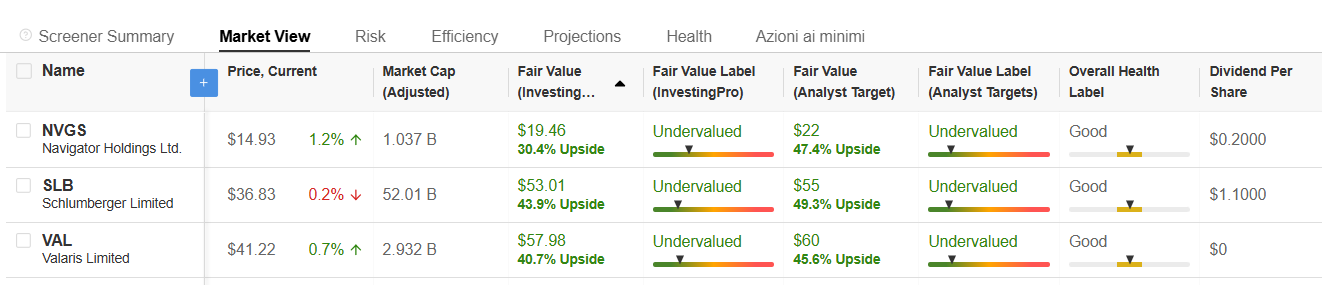

After making use of these filters, three standout shares emerge as sturdy candidates for 2025. These corporations not solely rating extremely on Piotroski’s scale however are additionally undervalued in line with analysts’ truthful worth estimates and goal costs:

Navigator Holdings (NYSE:) – Piotroski Rating 8, Truthful Worth +30.4%, Analyst TP +47.4%

Schlumberger NV (NYSE:) – Piotroski Rating 9, Truthful Worth +43.9%, Analyst TP +49.3%

Valaris (NYSE:) – Piotroski Rating 8, Truthful Worth +40.7%, Analyst TP +45.6%

Unlock the potential to focus on strong, undervalued shares poised for important progress in 2025 through the use of the technique we have outlined.

Curious how the world’s high buyers are positioning their portfolios for subsequent yr utilizing methods identical to this one?

Don’t miss out on the New Yr’s supply—your ultimate likelihood to safe InvestingPro at 50% low cost.

Get unique entry to elite funding methods, over 100 AI-driven inventory suggestions month-to-month, and the highly effective Professional screener that helped establish these high-potential shares.

Able to take your portfolio to the following degree? Click on the banner under to find extra.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to speculate as such it’s not meant to incentivize the acquisition of property in any means. I want to remind you that any kind of asset, is evaluated from a number of views and is very dangerous and subsequently, any funding choice and the related threat stays with the investor.